Roll of Shame

American Funding of Illegal Israeli Settlements

The United States tax code enables Americans to make tax-exempt donations to organizations engaged in settlement activities that:

- entrench the Israeli occupation of the Palestinian Territory and thereby strengthen the obstacles and barriers to creating a viable Palestinian state;

- damage the peace process;

- undermine our nation’s vital national interest by making it more difficult to resolve the conflict on the basis of a two-state solution;

- posse a security threat to the United States and its citizens by creating a reservoir of resentment and anger that strengthens Hamas, Hezbollah, and other extremist organizations committed to armed struggle;

- strengthen Iranian influence in the region by exploiting the continuation of the occupation;

- encourage resistance to Israeli security forces that enforce government orders to stop settlement construction;

- promote violence against Palestinians; and

- weaken Israeli leaders attempting to resolve the Israeli-Palestinian conflict on the basis of a two state solution;

www.SettlementsinPalestine.org has compiled data from the public record to illustrate the magnitude of these activities. The data is presented in two tables:

While some donors to these organizations may have known that their contributions would strengthen the occupation

and prevent the creation of a viable Palestinian state, there are probably many others who intended that their money

be used for humanitarian services but have unwittingly perpetuated the Israeli-Palestinian conflict and thereby have

undermined American’s vital national interests. In order to support the peace process, strengthen the ability of the

Israelis to take the actions they must take, eliminate the existential threat to creating a viable Palestinian state, and

promote America’s interests, the 501(c)(3) status of these organization should be questioned.

|

A few essays directly addressing the problem of American tax-exempt funding of Israeli settlements

|

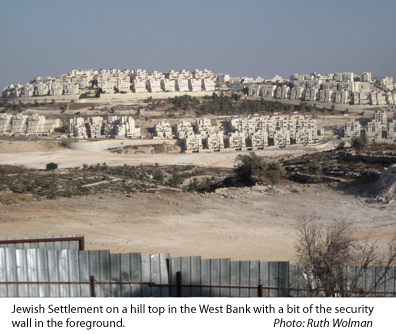

Israeli settlements in the Occupied Palestinian Territory (OPT, the

West Bank and the area annexed to Jerusalem after the Six Day War) have consequences for American

national interests and security. Whether driven by Israelis who claim they are the descendants of a late

Iron Age people who heard voices they thought was God telling them that the land is theirs, or created

by Israelis who argue the settlements are necessary for their country’s security, or resided in by Israelis

who seek an inexpensive suburban life, the consequence are the same. Settlements:

Israeli settlements in the Occupied Palestinian Territory (OPT, the

West Bank and the area annexed to Jerusalem after the Six Day War) have consequences for American

national interests and security. Whether driven by Israelis who claim they are the descendants of a late

Iron Age people who heard voices they thought was God telling them that the land is theirs, or created

by Israelis who argue the settlements are necessary for their country’s security, or resided in by Israelis

who seek an inexpensive suburban life, the consequence are the same. Settlements: